FHA Loans:

Affordable Homeownership with Low Down Payments

FHA loans make homeownership possible with as little as 3.5% down, flexible credit requirements, and competitive interest rates.

A Smart Choice for First-Time & Low Credit Homebuyers.

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration (FHA). It’s designed to help first-time homebuyers, lower-credit borrowers, and those with limited savings qualify for homeownership.

Key Benefits of FHA Loans:

Low Down Payment – As little as 3.5% down with a 580+ credit score.

Lower Credit Score Requirements – Available to borrowers with scores as low as 500 (with 10% down).

Competitive Interest Rates – FHA loans often have lower rates than conventional loans.

Flexible Debt-to-Income (DTI) Ratios – Higher DTIs are allowed compared to conventional loans.

Gift Funds Allowed – Down payments can come from family gifts or assistance programs.

Who Qualifies for an FHA Loan?

FHA loans are designed to be more accessible than conventional loans. Here’s what you’ll need to qualify:

Credit Score: 580+ for 3.5% down (500-579 requires 10% down).

Debt-to-Income Ratio (DTI): 50% or lower (varies by lender).

Loan Limits: Up to $498,257 in most areas (higher in expensive markets).

Primary Residence Only: FHA loans cannot be used for second homes or investment properties.

Stable Employment & Income: Two years of steady income history preferred.

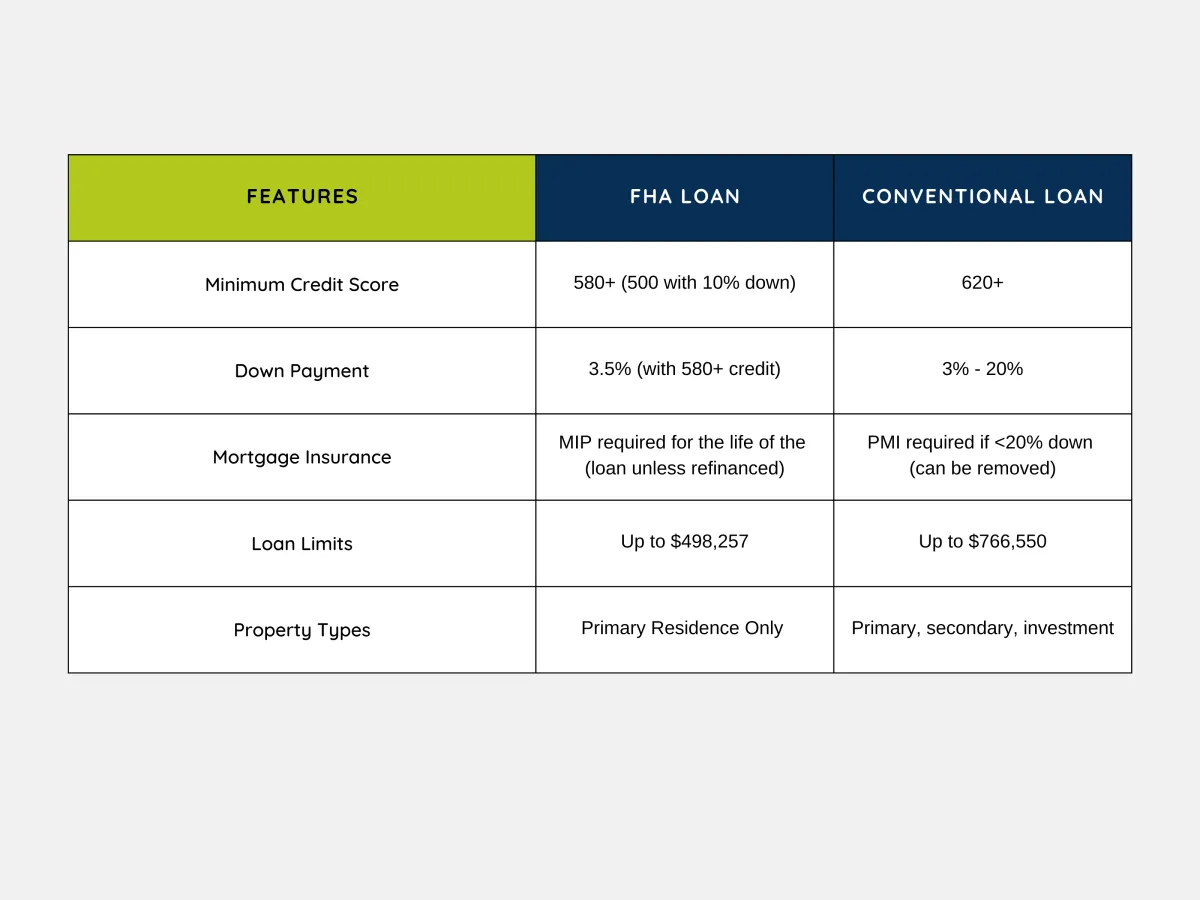

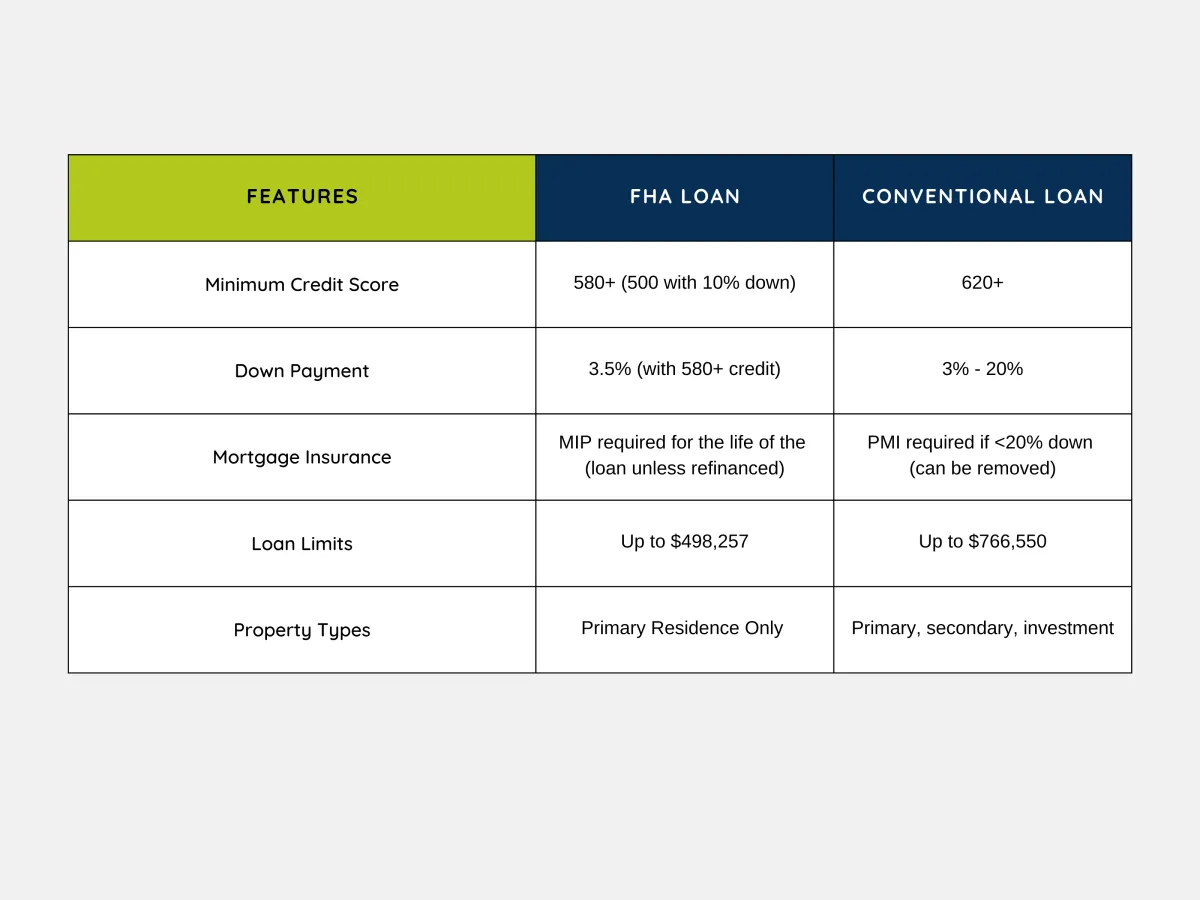

FHA or Conventional: Which Loan is Right for You?

Below are the loan programs we offer, each designed to fit different homebuyer needs. Click each option to learn more about eligibility, benefits, and application steps.

Who Should Choose an FHA Loan?

First-time homebuyers with low savings for a down payment.

Homebuyers who don’t qualify for a conventional loan due to income or credit limits.

Borrowers with credit challenges looking for flexible approval.

FHA or Conventional: Which Loan is Right for You?

Below are the loan programs we offer, each designed to fit different homebuyer needs. Click each option to learn more about eligibility, benefits, and application steps.

Who Should Choose an FHA Loan?

First-time homebuyers with low savings for a down payment.

Homebuyers who don’t qualify for a conventional loan due to income or credit limits.

Borrowers with credit challenges looking for flexible approval.

Explore FHA Loan Options

Standard FHA Loan (203b)

The most common FHA loan for buying a primary residence

FHA 203(k) Renovation Loan

Includes financing for both home purchase and repairs

FHA Streamline Refinance

Simplified refinance process for current FHA borrowers to lower their rate.

Answers to Common FHA Loan Questions

Can I use an FHA loan for an investment property?

No, FHA loans are only for primary residences.

What’s the minimum credit score for an FHA loan?

• 580+ = 3.5% down

• 500-579 = 10% down

Can I get an FHA loan with student loan debt?

Yes! FHA loans allow higher debt-to-income ratios than conventional loans.

How long does an FHA loan take to close?

Most FHA loans close in 30-45 days, depending on lender processing times.

Take the First Step Toward Homeownership.

An FHA Loan is a great option for first-time buyers, those with lower credit, and anyone looking for a low down payment mortgage. Let’s find the best option for you today!

Harmony Home Mortgage provides expert home loan solutions, including FHA, VA, Conventional, USDA, and Non-QM loans. Licensed in FL, GA, NC, SC, and MI, we make homeownership simple and stress-free.

Business Hours

Monday – Friday: 9 AM – 6 PM

Saturday: 10 AM – 2 PM

Sunday: Closed

Mortgage Services

Resources

Company

Legal & Compliance

Harmony Home Mortgage is an independent mortgage broker licensed in Florida, Georgia, North Carolina, and Michigan.

NMLS ID: 1162063

Business NMLS ID: 2629625

All loans are subject to underwriting approval. This is not a commitment to lend. Terms and conditions apply.

Legal Pages

Follow Us Online

Blog Sign Up

Stay updated on mortgage tips, market trends, and homebuying resources.

Harmony Home Mortgage provides expert home loan solutions, including FHA, VA, Conventional, USDA, and Non-QM loans. Licensed in FL, GA, MI, and NC, we make homeownership simple and stress-free.

Business Hours

Monday – Friday: 9 AM – 6 PM

Saturday: 10 AM – 2 PM

Sunday: Closed

Mortgage Services

Resources

Company

Legal & Compliance

Legal & Compliance

Harmony Home Mortgage is an independent mortgage broker licensed in Florida, Georgia, and Michigan.

NMLS ID: 1162063

Business NMLS ID: 2629625

All loans are subject to underwriting approval. This is not a commitment to lend. Terms and conditions apply.

Legal Pages

Follow Us Online

Newsletter Sign Up

Stay updated on mortgage tips, market trends, and homebuying resources.